Natural gas is the purest and cleanest fossil fuel that exists, it generates fewer emissions than other fossil fuels, making it an environmentally friendly fuel, it has approximately 30% less carbon intensity compared to diesel and its purity implies less processing and less generation of emissions in its production; aspects that make it the preferred fuel to reduce CO2 emissions.

The presence of Latin America in the global natural gas market currently represents 7.5% of gas pipeline trade and 6.2% of LNG. Latin America is a net importer of natural gas, although it has reserves equivalent to 4.2% of world reserves, those are still largely undeveloped. The region has an important exporting country: Trinidad and Tobago, whose GLN Atlantic Complex (Atlantic LNG Facility) exported approximately 25.1 million cubic meters of GLN in 2018. Despite relatively small volumes at the global scale, if the growing pace continues, the region could become an important world player for this market.

The Inter-American Development Bank (IDB) has estimated that the region´s demand for electricity could increase by more than 70% between 2016 and 2030. For Latin America, the availability of large amounts of LNG from the United States represents an opportunity to diversify its energy matrix, improve energy security and in some countries, reduce greenhouse gas emissions in the energy sector, where US LNG can provide an alternative source of energy at more competitive prices.

The percentage of natural gas in the regional electricity matrix is increasing as the share of other fuels declines. The demand for natural gas will increase from 107 bcm to 140 bcm annually by 2030, which leaves ample room for the growth of natural gas in electricity generation; additionally, natural gas is also used in transportation and in certain industries, such as oil production and steel manufacturing.

Thanks to the Vaca Muerta exploration, Argentina reached the second place in global shale gas reserves. In May 2019, YPF commissioned its first LNG cargo, achieving a historic milestone by becoming the first Argentine company to export LNG in its history. This is part of a process that YPF is leading, aiming to have a regional integration where it will become the main supplier of gas for consumption in neighbouring countries. The state company has plans to build a liquefaction terminal for natural gas exports, a project that will require an estimated investment of US $ 5 billion and will give the country access to large importers worldwide.

In Chile, the national government wants to increase the share of this fuel in the market, both for industrial and residential demand and in electricity generation, therefore an infrastructure investment throughout the country is on the rise. Mexico has increased its use of natural gas for power generation and imports LNG from several countries, including Peru, Nigeria, Qatar, and the United States, and joins other Caribbean countries in projects for modifying oil-powered power plants to run on gas to reduce both costs and pollution. Peru, Argentina, and Brazil are increasing their production, possibly achieving self-sufficiency throughout the 2020s. Colombia is considering a second LNG import terminal to adapt to future gas requirements.

Technological innovations have generated new transport options for liquefied natural gas (LNG) and provide more flexibility for countries to import this fuel seasonally or on a small scale. For some countries in Latin America and the Caribbean, especially those that currently burn fuel or coal to generate electricity, these factors can help change the role of LNG in their energy matrix. An example of technological innovation is the floating storage and regasification units (FSRU) - with which large devices can dock at a port and link with existing infrastructure - Brazil and Argentina have used FSRU to partially meet seasonal demand.

The region continues to boost the development and modernization of the gas industry; throughout Latin America, there are over 30 projects that will be developed in the coming years, which shows the great potential the region has within the LNG global industry. Chile approved in 2019 an LNG Terminal with an investment of US$ 165M. Bolivia will export liquefied natural gas (LNG) through Argentine ports and will make investments of over US$ 200 M in the regasification terminals of Bahía Blanca and Escobar. Colombia has approved the construction of the Pacific LNG terminal that will require an investment f around US$ 300 M; this year Ecuador will be issuing a tender for developers for a 500 MW combined-cycle power plant project.

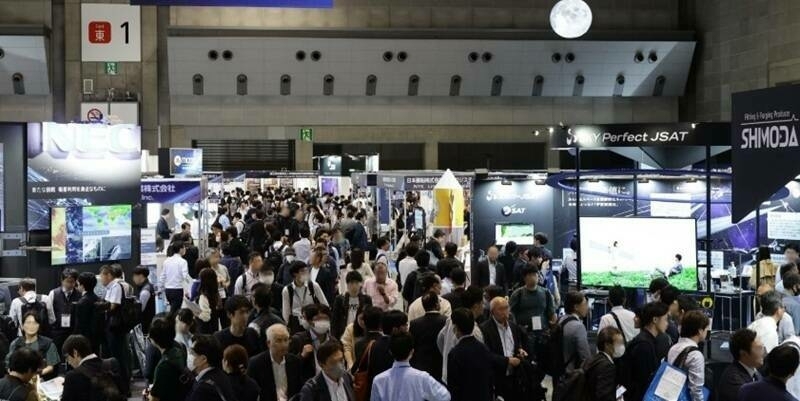

If you want to learn more about these and other projects, join 250+ decision-makers of the LNG LATAM industry at LNG Latin America Congress (June 17-18, Buenos Aires, Argentina), where you will have access to first-hand information on projects, implementation, innovation, financing, regulation and all that is new in this thriving industry.

Contact person: Laura Polo, Congress Producer

Email: [email protected] Tel. +44 207 394 3090

Website: https://bit.ly/3cvI3nD

Catalina Velasco, Marketing Manager Latin America

Email: [email protected]

Whats app: +5521999554087

Subscribe to our newsletter

Stay updated on the latest technology, innovation product arrivals and exciting offers to your inbox.

Newsletter