Karlsruhe, Frankfurt/Main, October 9, 2018. Professor Harald Simons has become renowned for making controversial predictions that are not always welcomed. As a member of the “Immobilienweisen” expert panel for the German Property Federation (ZIA) for many years, as well as a board member at the Empirica research group, Simons triggered a huge torrent of diverse reactions and counterarguments when the Spring Real Estate Industry Report 2018 was published. At the INTERGEO CONFERENCE this year, he is set to spark lively debate once again with his keynote speech – scheduled for 9:30 a.m. on Thursday, 16 October.

After all, anyone daring to predict a change in trend for Germany’s property market is bound to face strong headwinds. In a sector representing 800,000 companies, a workforce of 2.7 million, and some 500 billion euros in gross value added, the prospect of economic losses causes understandable concern. “I certainly wouldn’t say I have that much influence,” Simons laughs, referring to the criticism his predictions attracted. He has often joked: “Give me ten million and I would be happy to predict continued growth in property prices. But so far no one has offered me the money.” So it seems his voice does not extend quite that far. However, with or without the millions, Professor Simons stands by his forecast: “In all seriousness, I still expect prices in Munich and Berlin to crumble.”

For Simons, this is not just a prediction – the indications are already plain to see. He emphasises that any comparison of current purchase prices and average rents in these two cities shows that the situation is completely out of sync: “If you pay 45 times what a property is worth when you buy it, you have to assume that you can’t earn any money from it.” In his view, this amounts to vast quantities of “silly money” on the market – it doesn’t take an expert mathematician to see that buyers are paying too much.

Simons also predicts a number of other trends. For instance, he expects demand in Munich and Berlin to drop dramatically, especially among 20- to 35-year-olds, as this younger generation is drawn to other, more affordable cities. Leipzig, Erfurt, Rostock, Erlangen, Augsburg and Bamberg are likely to benefit here, offering everything required for a good quality of life – and at half the price. In fact, figures show that Berlin and Munich are already net losers in terms of migration patterns within Germany, says Simons. Meanwhile, the large waves of immigration into the country seen in recent years are essentially over for the moment: “Having so many people from all over the world entering Germany at once is clearly not a normal state of affairs.” Meanwhile, with demand decreasing, “we are seeing a significant increase in construction.” For property prices to continue rising, there needs to be a perfect configuration of demand, supply and interest rates – but Simons says this cannot be expected. “And that needs to be said loud and clear,” confirms Germany’s top property trendspotter.

The implications certainly are loud and clear, with Simons predicting in the Spring Real Estate Industry Report 2018 that property prices in the two hot spots of Berlin and Munich will drop by 25 to 30 percent in real terms over the next five years. Although this may seem like a lot, it would only represent a return to 2015 prices, and would ultimately hurt nobody other than investors: “There’s no rule that says anyone has an absolute right to turn a profit.” For renters, the situation will remain tense, and Simons certainly does not see prices becoming more affordable within the next few years.

Professor Harald Simons will be analysing the German property market in his keynote speech on Thursday, 18 October at 9:30 a.m. Visitors can expect a well-researched, analytical and charismatic approach to an overview of pretty much anything in Germany that has foundations, walls and a roof.

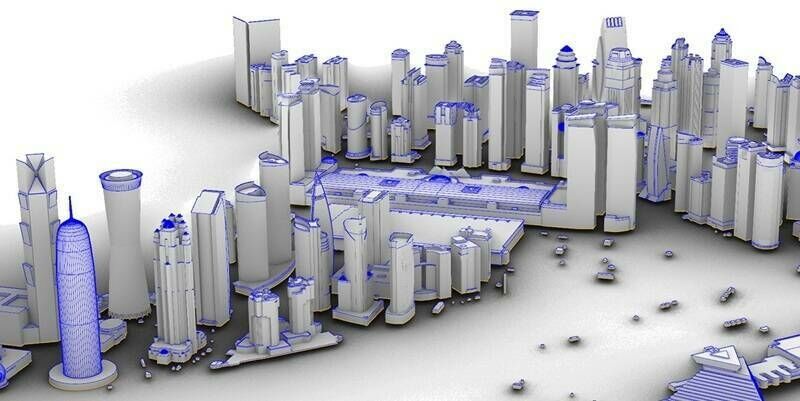

Property valuation is a key topic for the conference programme on the closing day of INTERGEO 2018 – and an absolute must for everyone involved in the property market.

Tickets are available for purchase now from www.intergeo.de/tickets

Subscribe to our newsletter

Stay updated on the latest technology, innovation product arrivals and exciting offers to your inbox.

Newsletter